- The backlog totals over €7 billion at the end of June 2024

- Revenues are up 15%, with double-digit year-on-year growth in all of the divisions; these grow by 8% in the second quarter of 2024

- The EBITDA and EBIT record respective year-on-year rises of 22% and 29%; in the second quarter alone, the increase stands at 17% and at 21% with respect to the same period of 2023

- Profitability has improved once again during the quarter, in terms of the EBITDA margin (10.0% in the quarter versus 9.4% in the same period of the previous year) and the EBIT margin (7.8% versus 6.9%)

- The net result totals €114 M, rising by 27% with respect to the first six months of 2023

- Free Cash Flow (FCF) increases by 27% year-on-year

- The year-end targets rise for revenues (>€4,800 M), EBIT (> €415 M) and FCF (> €260 M)

- The acquisitions of the GTA simulation company and Totalnet from Chile, which specializes in payment methods, were completed during the first quarter

In reference to the results, Indra Chairman Marc Murtra explained that “we’re continuing to optimize our operations and we have proof of the improvements that can be observed in the EBITDA and EBIT margins”. He also added that “we’re in the process of implementing Indra’s Technological Plan, which entails aligning our production capabilities and R&D-related commitments with the key technologies and products we’ve identified, as we announced on Capital Markets Day. We believe this is one of the most significant tasks we have to perform to ensure Indra’s medium-term success”.

In reference to the financial results, Indra’s CEO, José Vicente de los Mozos, declared that:

“The speed with which Indra’s teams have begun to deploy the Leading the Future Strategic Plan has already had positive consequences for the company, which have been reflected in higher-than-expected growth in terms of revenues, EBITDA, EBIT and free cash flow. The result of the above is an upward revision of the targets we set ourselves for the whole of the 2024 financial year”.

Most significant aspects

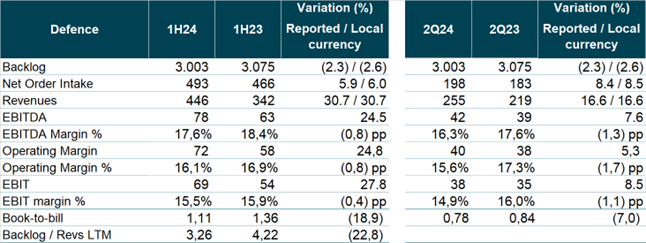

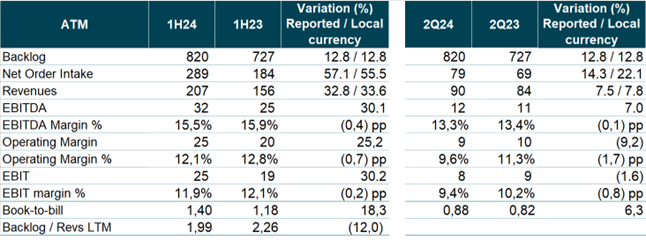

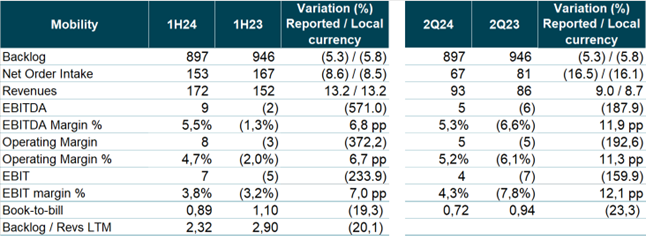

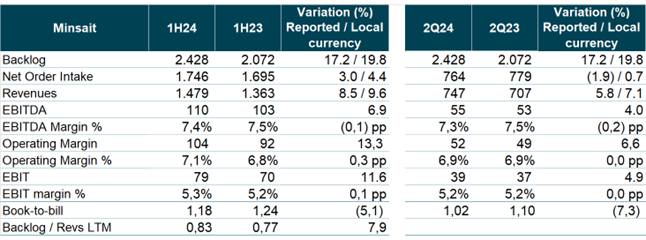

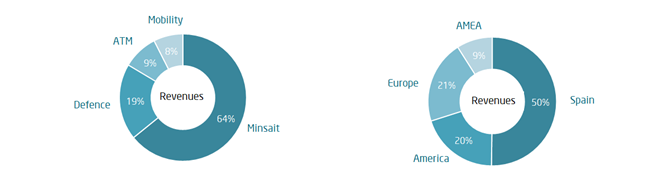

Indra’s revenues in the first quarter of 2024 rose by 15%, and all of its divisions displayed stable growth (ATM rose by 33%, Defence by 31%, Mobility by 13% and Minsait by 9%). In the second quarter of the year, the above increase in revenues occurred in all of the business divisions: Defence 17%; Mobility 9%; ATM 8% and Minsait 6%. The exchange rate deducted €16 M from the revenues during the quarter (-0.8pp), mainly due to the depreciation of the currencies of Argentina and Chile. The fall totaled €9 M in the quarter (-0.8pp).

Organic revenues (excluding the inorganic contribution of acquisitions and the exchange rate effect) rose by 12% in the first six months of the year. By divisions, there were increases in revenues in Defence (29%), ATM (19%), Mobility (13%) and Minsait (7%). With respect to the second quarter alone, organic revenues rose by 6% (Defence 15%, Mobility 9%, Minsait 4%), although ATM fell by 2%.

By geographical fields, all of the areas in which Indra operates showed signs of growth in the first six months of 2024. Specifically, Spain, which increased its revenues by 15%, remains the country with the highest percentage of the company’s sales (50%). Then comes Europe, which accounted for 21% of the sales and grew by 23% during the period. They are followed by the Americas, with an 8% increase and a 20% share of the global revenues, and Asia, Middle East and Africa (AMEA), with 6% growth in the quarter, a figure equivalent to 9% of the total sales.

Steady backlog growth

The backlog in the first half of 2024 totaled €7.148 billion, up 5% compared to the same period of the previous year, driven by Minsait and the ATM division. The ratio between the backlog and sales in the last twelve months stood at 1.54x, set against the figure of 1.68x in the same months of the previous year.

The net order intake during the quarter increased by 7%, with growth in all of the divisions except Mobility. ATM recorded particularly strong growth, chiefly due to the contracts in Canada and Colombia. The book-to-bill ratio stood at 1.16x, set against the figure of 1.25x in the same period of the previous year.

Other variables

During the first six months of the current year, the EBITDA margin stood at 10.0%, set against the figure of 9.4% in the same period last year, an increase of 22% in absolute terms. This rise can mainly be put down to the growth recorded in the divisions with the greatest operating profitability (Defence and ATM), as well as the improved returns of Mobility. In the second quarter of the year, the margin rose to 9.6% (versus 8.9% in the second quarter of 2023) and displayed 17% growth in absolute terms, despite the higher structural costs resulting from the deployment of the strategic plan and the one-off costs of potential acquisitions and divestments currently under analysis, which are mainly affecting the Defence division.

The Operating Margin in the quarter stood at 9.1%, compared to the figure of 8.3% in the same months of the previous year, with 26% growth in absolute terms. With regard to the quarter alone, the operating margin totaled 8.9%, set against 8.3% in the same period of 2023.

As for the EBIT margin, it stood at 7.8% in the first six months, compared to 6.9% in the first quarter of the previous year, an increase of 29% in absolute terms. In the second quarter, the margin rose to 7.5% from 6.7%, representing a 21% increase in absolute terms.

The Net Result rose to €114 M from €90 M in the first half of 2023, an increase of 27%. The net result went up by 15% in the second quarter.

The Free Cash Flow in the period stood at €69 M, compared to €54 M in the first six months of the previous year, an improvement mainly due to the greater operating profitability. In the three months of the second quarter, the cash flow generation totaled €1 M (including the payment of €41 M for the IRPF (income tax) corresponding to the delivery of the shares of the mid-term remuneration system for the 2021-2023 period), compared to the figure of €28 M recorded in the same months of 2023.

Finally, the Net Debt stood at €93 M in June 2024, set against the figures of €107 M in December 2023 and €47 M in June 2023. The Net Debt/LTM EBITDA ratio (excluding the impact of IFRS 16) stood at 0.2x in June 2024, compared to 0.3x in December 2023 and 0.1x in June 2023.

New 2024 Targets

The company has updated its 2024 goals, revising them upwards:

- Revenues in local currency: greater than €4.8 billion (up from greater than €4.65 billion, as forecast at the start of the year).

- Reported EBIT: greater than €415 M (up from greater than €400 M).

- Reported Free Cash Flow: above €260 M (up from above €250 M in the previous forecast).

Key Highlight

Acquisitions accounted for €70m in 1H24 sales vs €4m in 1H23. In Minsait, the acquisitions of NAE, Deuser, ICASYS, Tramasierra and Totalnet contributed inorganically, in ATM the Selex Air Traffic business in the US, and Park Air. In Defence, GTA contributed (after increasing its stake from 35% to 100%). In the quarter, these acquisitions contributed €35m in 2Q24 vs €4m in 2Q23.

Revenues by divisions and geographical areas

About Indra Group

Indra Group is a holding company that promotes technological progress. It includes Indra, one of the main global defense, air traffic and space companies; and Minsait, leading digital transformation and information technologies in Spain and Latin America. Indra Group promotes a safer and more connected future through innovative solutions, trusted relationships, and the best talent. Sustainability is part of its strategy and culture, to respond to present and future social and environmental challenges. At the end of the financial year 2023, Indra Group had revenues of 4,343 million euros, more than 57,000 employees, local presence in 46 countries and commercial operations in more than 140 countries.