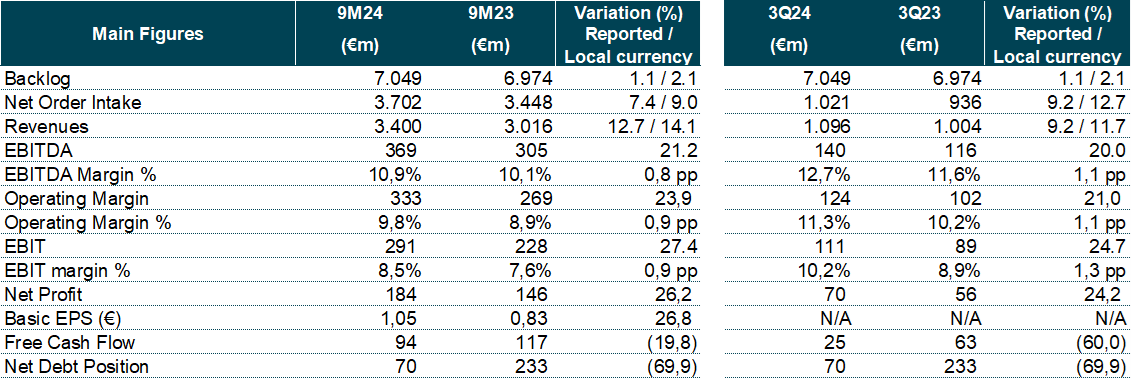

- The net profit amounts to €184 million, rising by 26% with respect to the same period in 2023

- Revenues grew by 13%, with double-digit year-on-year increases in Defence, Air Traffic Management (ATM) and Mobility. Third quarter revenues rose by 9%

- The EBITDA and EBIT record respective year-on-year rises of 21% and 27%; in the third quarter alone, the increase stands at 20% and at 25% with respect to the same period of 2023

- Profitability has improved once again, in terms of the EBITDA margin (10.9% in the first nine months versus 10.1% in the previous year) and the EBIT margin (8.5% versus 7.6%)

- The backlog continues to exceed €7 billion at the end of September 2024

- The financial targets for 2024 are confirmed, which were already raised last July, in terms of revenues restated into constant currency (>€4.8 billion €), EBIT (>€415 million) and FCF (>€260 million)

- Net debt was reduced to €70 million in September 2024, compared to €233 million in September 2023. In the third quarter, the Indra Group also received a dividend of €60 million for its stake in ITP

- During the quarter, the acquisitions of Deimos in the Space business and MQA in Minsait’s SAP solutions business were announced

- Indra acquires the majority of TESS Defence, and it becomes the Spanish benchmark in land defence programmes

- Implementation of the “Leading The Future” Strategic Plan is progressing as planned

Marc Murtra, executive chairman of Indra, in reference to Indra’s results, said that “the continuous improvement in operations and management is bearing fruit, visible in our results, which are good and confirm that we are executing our strategy. Acquisitions such as Deimos and MQA strengthen our capabilities in key sectors, such as aerospace and technology, and are consistent with our strategy. We have a clear objective and we continue to move towards it.”

José Vicente de los Mozos, CEO of Indra, stated that “we continue to work on implementing our Strategic Plan ‘Leading the Future’. In terms of results, we can affirm we are in a process of continuous improvement as a result of the actions implemented, thanks to the effort and commitment of all Indra employees”.

Highlights

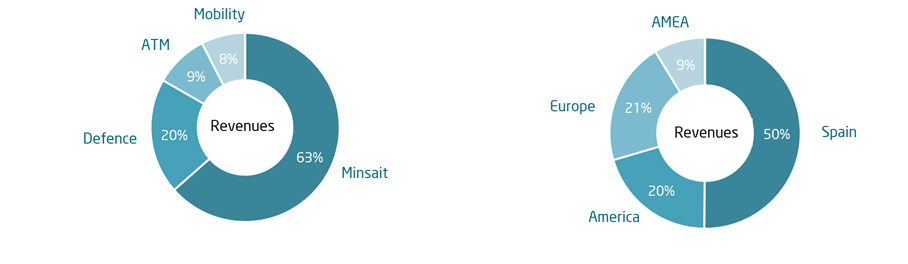

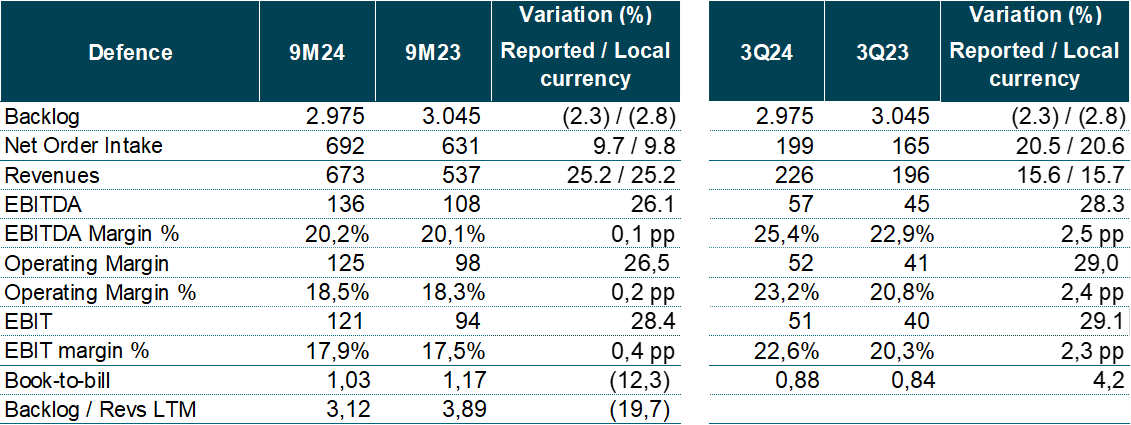

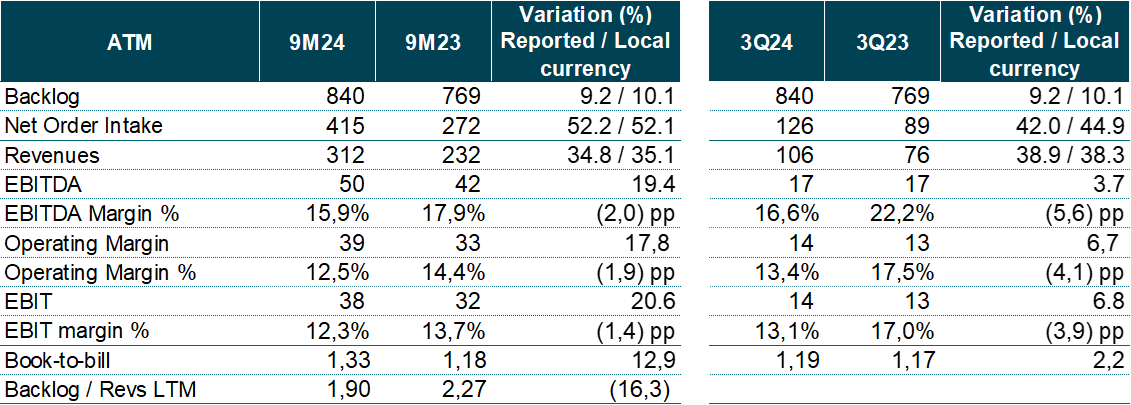

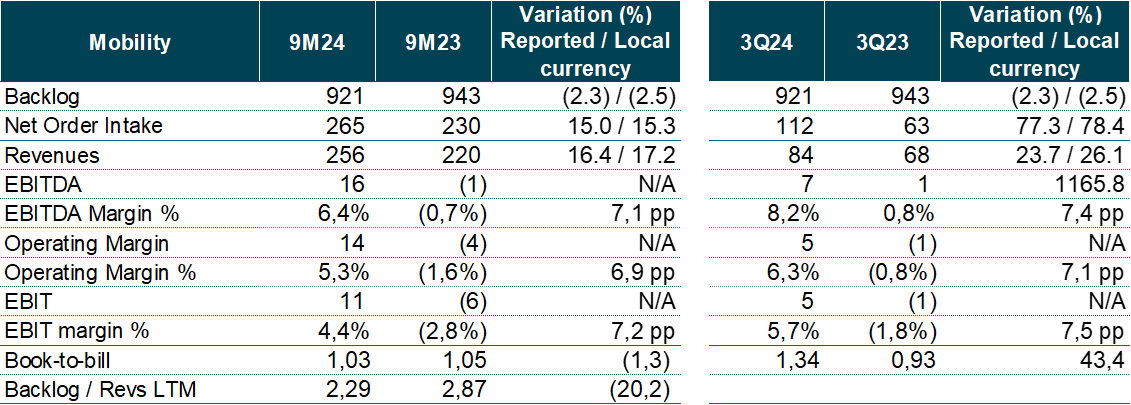

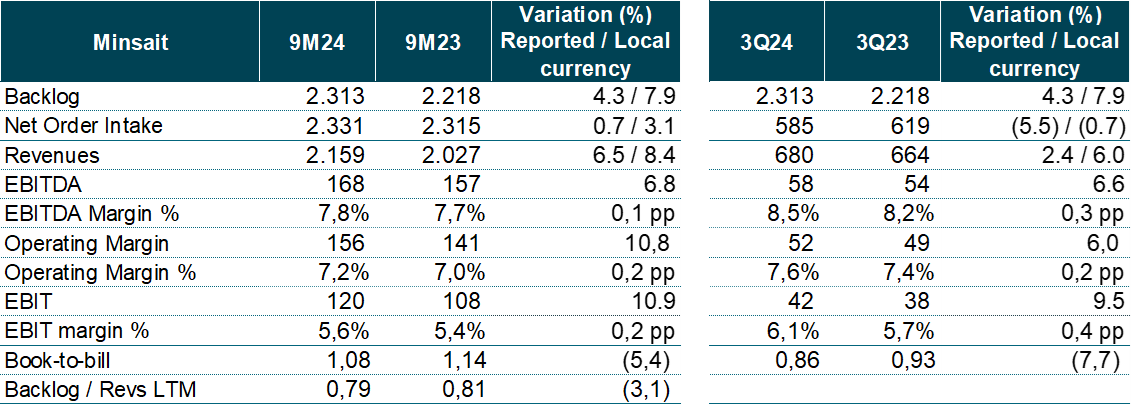

Indra Group’s revenues in the first nine months of 2024 rose by 13%, and all of the group’s divisions showed strong growth, with ATM leading the way with a 35% increase; followed by Defense with 25%; Mobility with 16% and finally Minsait, whose revenues went up by 7%. In the third quarter alone, increases were also recorded in all divisions (ATM up 39%; Mobility 24%; Defense 16% and Minsait 2%). The FX deducted €41 M from the revenues during the period (-1.4 pp), mainly due to the depreciation of the currencies of Argentina and Chile. FX reduced the figure by €25 M (-2.5 pp) during the quarter, mainly because of the depreciation of the Brazilian peso and the Mexican peso.

Organic revenues up to September 2024 (excluding the inorganic contribution of acquisitions and the FX effect) rose by 11% with progress in all divisions: Defense 23%; ATM 23%; Mobility 17% and Minsait 6%. In the quarter, organic revenues increased 9% (ATM 33%; Mobility 26%; Defense 14% and Minsait 3%).

On the other hand, revenues by geography showed solid growth, led by Europe, which grew by 17% and now accounts for 21% of total sales. In second place is Spain, whose 15 % increase continues to account for the majority of Indra Group sales (50 percent). In third place, the Asia, Middle East and Africa (AMEA) markets increased their revenues by 8%, representing 9% of sales, and the Americas increased by 4%, accounting for 20%.

Backlog continues to grow

Backlog for the January-September period reached €7.049 billion, up 1% versus the same months of the previous year, driven by Minsait and ATM. With respect to the last 12 months, the ratio between the backlog and sales stood at 1.49x vs. 1.67x in the first nine months of 2023.

The net order intake in the first nine months of the year increased by 7%, with growth in all the divisions. In this regard, it is worth highlighting the strong growth in ATM, mainly due to the contracts signed in Canada and Colombia during the first quarter of 2024. The book-to-bill ratio for order intakes stood at 1.09x vs.1.14x in the same period of the previous year.

Other important variables

Over the period to September 30, 2024, the EBITDA margin stood at 10.9% versus 10.1% in the same period in 2023, with a growth in absolute terms of 21%. This rise can mainly be put down to the growth recorded in the divisions with the greatest operating profitability, that is, Defense and ATM, as well as the improved returns of Mobility, Defense and Minsait. For the third quarter alone, the margin also improved to 12.7% versus 11.6% and grew by 20% in absolute terms.

In the nine months of 2024, the operating margin was 9.8% compared to 8.9% in the previous year, an increase of 24% in absolute terms. Other operating income and expenses (difference between Operating Margin and EBIT) amounted to -€43 million versus -€41 million, with the following breakdown: workforce restructuring costs of -€23 million versus -€16 million; PPA (Purchase Price Allocation) impact on the amortization of intangibles of -€11 million versus -€12 million; and provision for stock-based compensation of the medium-term incentive of -€9 million versus -€13 million. In the third quarter, the operating margin reached 11.3%, compared to 10.2% for the same period in 2023; and other operating income and expenses were -€12 million versus -€13 million.

As for the EBIT margin, it stood at 8.5% in the first nine months of 2024, compared to 7.6% in the previous year, an increase of 27% in absolute terms. In the third quarter, the margin rose to 10.2% from 8.9%, representing a 25% increase in absolute terms.

Net profit in the nine-month period analyzed amounted to €184 million compared to €146 million in the same space of time in the previous year, an increase of 26%. The net profit rose by 24% in the quarter.

As for Free Cash Flow, it fell by €94 million versus €117 million in 9M23, due to the payment of €41 million of the IRPF corresponding to the delivery of shares of the medium-term remuneration system for the period 2021-2023 in the second quarter of 2024. FCF in the third quarter was €25 million versus €63 million in 3Q23, due to higher customer collections in that period of the previous year.

Finally, the net debt stood at €70 million in September 2024, set against the figures of €107 million in December 2023 and €233 million in September 2023. The Net Debt/LTM EBITDA ratio (excluding the impact of IFRS 16) stood at 0.1x in September 2024, compared to 0.3x in December 2023 and 0.6x in September 2023.

Goals for 2024

The 2024 financial targets, which were already increased last July, are confirmed:

- Revenues in local currency: higher than €4.8 billion.

- Reported EBIT: higher than €415 million.

- Reported Free Cash Flow: higher than €260 million.

Key Highlights

Acquisitions totaled €109 million in sales in 9M24 sales vs €14 million in 9M23. In Minsait, the acquisitions of NAE, Deuser, ICASYS, Tramasierra and Totalnet have contributed inorganically; in ATM, the Selex Air Traffic business in the USA, and Park Air. GTA contributed to Defense (after the increase in its stake from 35% to 100%). In the quarter, these acquisitions contributed €39 million in 3Q24 vs. €10 million in 3Q23.

Revenues by divisions and geographical areas