- The Backlog totaled over 7 billion euro at the end of March 2024

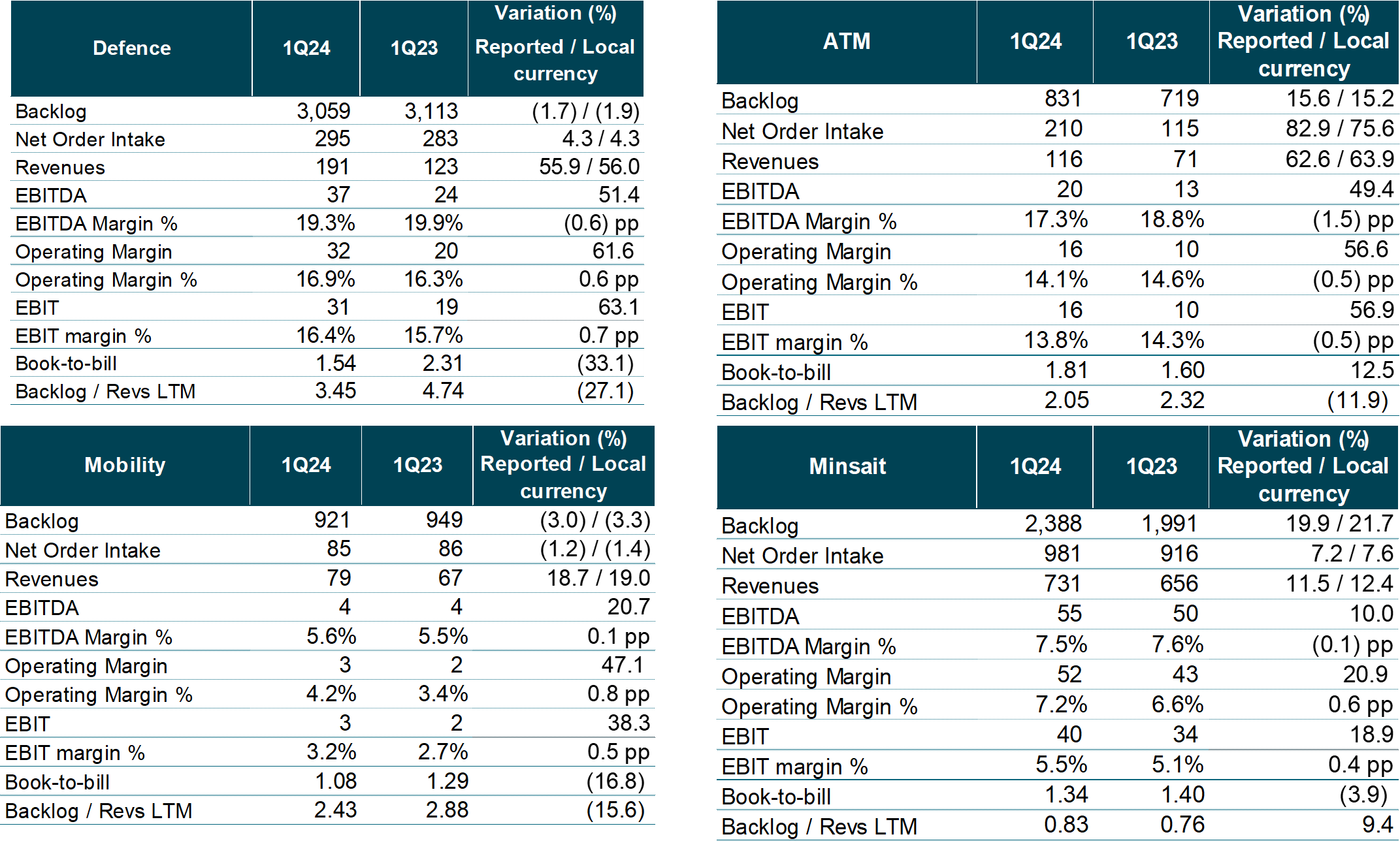

- Revenues increased by 22%, with double-digit year-on-year growth in all of the four divisions: Defence, ATM, Mobility and Minsait

- The company improved its profitability in terms of the EBITDA margin (10.4% in the first quarter of 2024 versus 10.0% in the same period of 2023) and the EBIT margin (8.1% in the first three months of the year versus 7.1% in the same period of the previous year)

- Earnings per share (EPS) rose by 42% compared with the first quarter of 2023

- Cash generation (FCF) amounted to €68 M in the quarter, compared with €27 M in the same period of the previous year

- Indra reiterates all its 2024 financial targets (revenues, EBIT and FCF)

- Indra completed the acquisition of GTA during the quarter, increasing its stake in the company from 35% to 100%

Madrid, May 6, 2024.

According to Indra Chairman Marc Murtra:

“We’ve made a firm start to the implementation of our Strategic Plan, the first milestone being the approval by the Board of Directors of the creation of Indra Espacio, an entity that will become the cornerstone of our activities in the space business. These are solid quarterly results and a small first step towards the execution of our strategy”.

In reference to the financial results, Indra’s CEO, José Vicente de los Mozos, said that:

“The first quarter of the year has been characterized by the significant growth of our commercial and financial indicators and improved profitability and cash generation, thanks to the hard work of all the men and women who are part of Indra. All of them, without exception, are focused on the effective deployment of our Strategic Plan - Leading the Future - that was announced on March 6. There is no doubt that these quarterly results constitute an excellent starting point to achieve the goals we’ve set ourselves”.a. Todos ellos, sin excepción, están centrados en el despliegue efectivo de nuestro Plan Estratégico -Leading the Future-, anunciado el pasado 6 de marzo. Sin duda alguna, estos resultados trimestrales conforman un gran punto de partida para conseguir los objetivos que nos hemos marcado”.

Main variables in the quarter

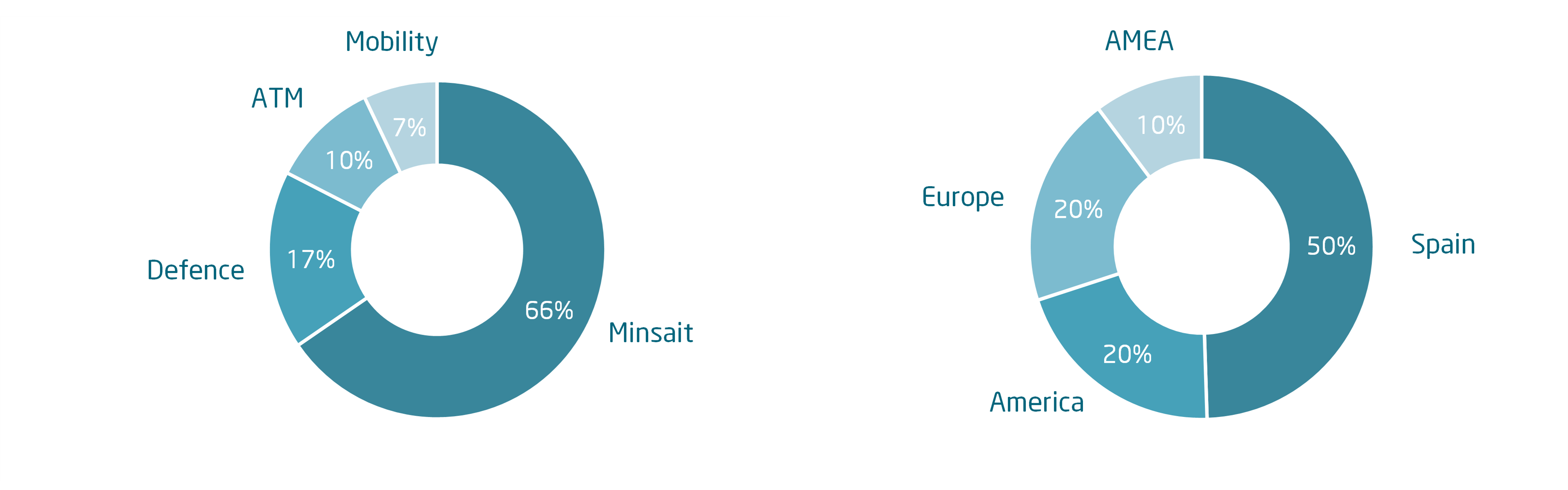

Indra’s revenues in the first quarter of 2024 (1Q24) rose by 22% and all of its divisions achieved double-digit growth (ATM 63%, Defence 56%, Mobility 19% and Minsait 12%).

FX differences deducted €7 M from revenues (-0.7pp), chiefly due to the appreciation of the Latin American currencies.

Organic revenues in the first three months of the year (excluding the inorganic contribution of acquisitions and the FX effect) rose by 19%. By divisions, Defence increased by 53%, ATM by 42%, Mobility by 19% and Minsait by 10%.

The backlog in 1Q24 totaled €7,199 M, an increase of 6% compared with the first quarter of 2023 (1Q23), driven by Minsait and ATM. The ratio between the backlog and sales in the last twelve months stood at 1.58x, set against the figure of 1.73x in the same months of the previous year.

The net order intake in the first quarter of the year increased by 12%, with growth in all of the divisions except Mobility. The sharp increase recorded by ATM (due in particular to the contracts in Canada and Colombia) and Minsait, especially in the Public Authorities & Health vertical (due to projects for the Spanish Public Administration and the preparation of elections) was considerable. The book-to-bill ratio stood at 1.41x vs. 1.53x in the same period of the previous year.

The EBITDA margin in 1Q24 stood at 10.4% set against 10.0% in 1Q23. This improvement in returns can mainly be put down to the growth recorded in the divisions with the highest operating profitability: Defence and ATM. The EBITDA grew by 27% in absolute terms.

The Operating margin in the first three months of the year reached 9.3% compared with the figure of 8.3% in the same months of 2023, with 37% growth in absolute terms.

Other operating income and expenses (i.e. the difference between the Operating Margin and the EBIT) amounted to minus €14 M versus minus €11 M in the first quarter of the previous year, with the following breakdown: workforce restructuring costs (minus €7 M vs. minus €4 M), provision for the share-based compensation in the mid-term incentive (minus €4 M in both periods) and the impact of the PPA (Purchase Price Allocation) on the amortization of intangibles (minus €3 M in both periods).

The EBIT margin in the first quarter of 2024 was 8.1% set against 7.1% in the same months of 2023 and recorded 38% growth in absolute terms.

The Net Profit in the same period amounted to €61 M compared to €44 M in the same space of time in the previous year, an increase of 40%.

The Free Cash Flow in 1Q24 was €68 M versus €27 M in 1Q23. This increase can mainly be put down to the greater operating profitability and the improvement in the working capital variation.

Net Debt stood at €89 M in March 2024, set against the figures of €107 M in December 2023 and €27 M in March 2023. The Net Debt/LTM EBITDA ratio (excluding the impact of IFRS 16) stood at 0.2x in March this year, compared with 0.3x in December 2023 and 0.1x in March 2023.

Key Highlight

Acquisitions totaled €35M in sales in 1Q24 sales vs €0M in 1Q23. The acquisitions of NAE, Deuser, ICASYS and Tramasierra inorganically contributed to Minsait, as did Selex’s Air Traffic business in the US and Park Air to ATM. GTA contributed to Defence (after the increase in its stake from 35% to 100%).

Revenues by divisions and geographical areas

Goals for 2024

- Revenues in local currency: higher than €4,650 M.

- Reported EBIT: higher than €400 M.

- Reported Free Cash Flow: higher than €250 M.

About Indra

Indra (www.indracompany.com) is one of the leading global defence, aerospace and technology companies, and a world leader in digital transformation and information technologies in Spain and Latin America through its subsidiary, Minsait. Its business model is based on a comprehensive range of proprietary products, with high-value approach and a significant innovative component, making it the technological partner for the digitalization and key operations of its clients around the world. Sustainability forms part of its strategy and culture in order to overcome current-day and future social and environmental challenges. In the 2023 fiscal year, Indra achieved revenue totaling €4.343 billion, with more than 57,000 employees, a local presence in 46 countries and business operations in over 140 countries.