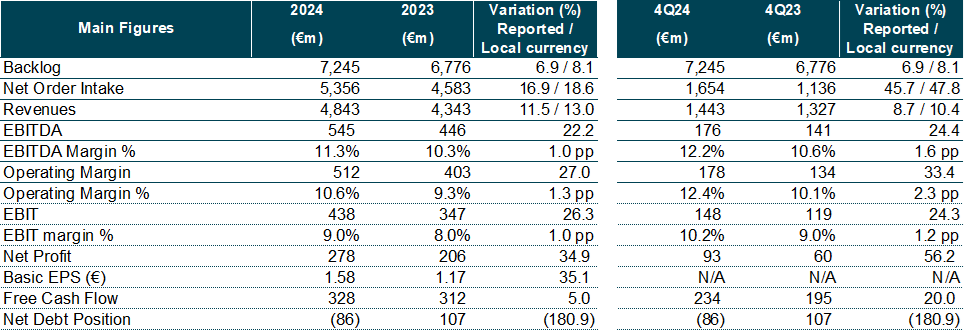

- Revenues increased by 12% in 2024 with respect to 2023, with double-digit year-on-year rises in Defence and ATM and a 17% upturn in order intakes

- The EBITDA and EBIT respectively recorded 22% and 26% year-on-year rises, with a 1% improvement in both margins, thanks to the greater operating efficiency and the change in the business mix

- The net profit totaled €278 M, rising by 35% set against 2023. With respect to the debt, the group ended December 2024 with a positive cash position amounting to €86 M, compared to the net debt of €107 M recorded in December 2023

- Indra announced a dividend payment of €0.25 per share out of the 2024 earnings, payable on July 10, 2025

Ángel Escribano, Indra Group’s executive chairman, expressed his satisfaction with the first financial results he has presented as head of the corporation: “The company boasts healthy accounts and a positive revenue balance sheet allowing us to progress in our growth strategy and make it even more ambitious. Since I’ve been here, I’ve been able to see that we have unrivaled professional technological talent, and unlimited capacity to continue innovating and growing in all of the areas the company operates in”.

Indra Group CEO José Vicente de los Mozos declared that “2024 has been an excellent and very strategic year for the company. We presented our Leading the Future Strategic Plan, with which we’ve instilled confidence in the market, improved our processes and laid the foundations for our growth as a leading Spanish company in Defence, Air Traffic, Space and Information Technologies. We’ve not only achieved the goals set for the year; the economic figures also give us sufficient financial muscle to expand our offer, increase our global scale and generate important alliances worldwide”.

Most significant variables in 2024

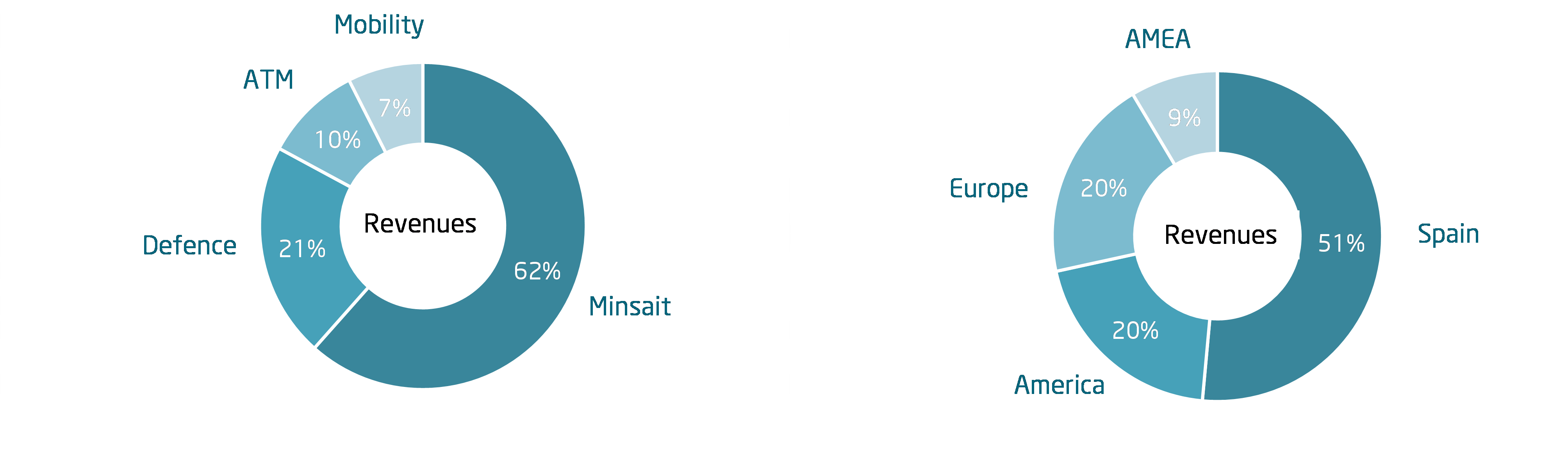

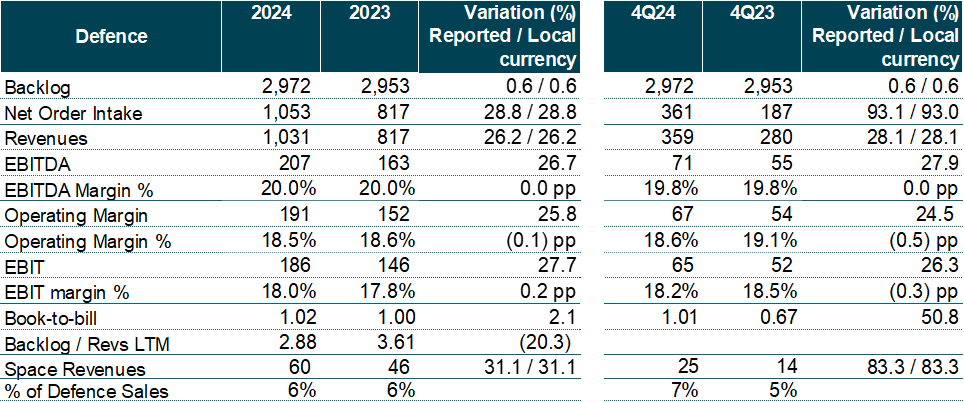

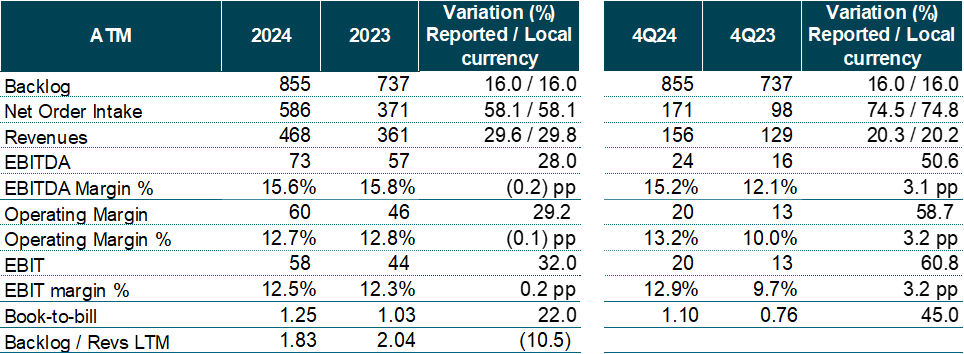

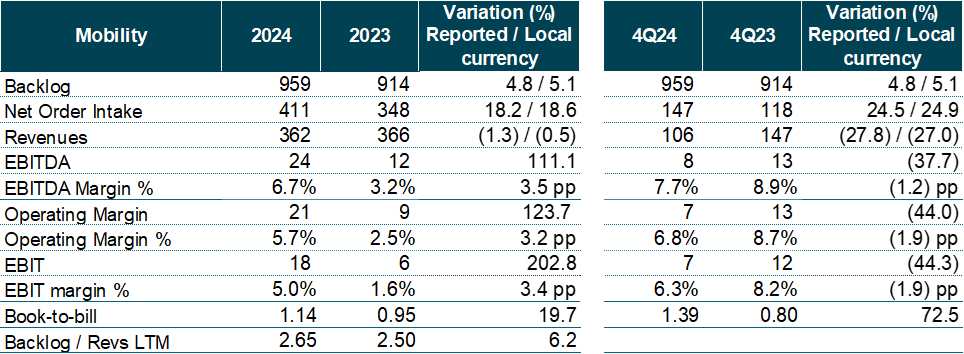

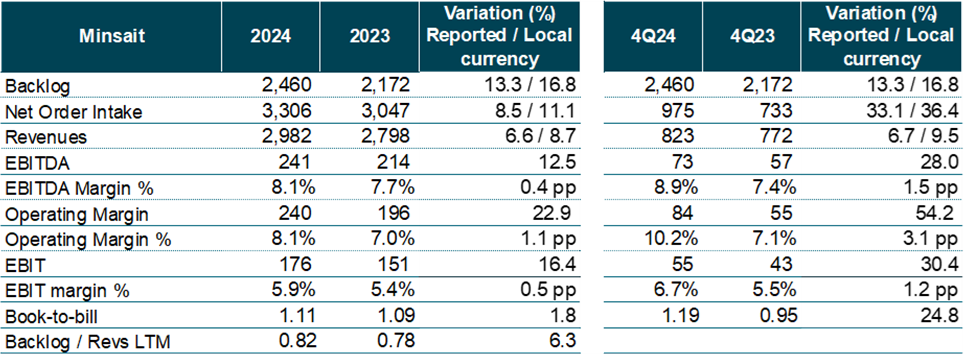

Revenues rose by 12% in 2024, with all of the divisions showing growth (ATM rose by 30%, Defence by 26% and Minsait by 7%), except for Mobility (which fell by 1%). In the fourth quarter of the year, revenues also rose in all of the divisions (Defence by 28%, ATM by 20% and Minsait by 7%), except for Mobility (down 28%).

The exchange rate deducted €64 M from revenues in 2024 (-1.5 pp), mainly due to the depreciation of the currencies of Argentina, Brazil and Chile. The exchange rate reduced the figure by €23 M (-1.7 pp) during the quarter, primarily because of the depreciation of the Brazilian real, the Mexican peso and the Argentinian peso.

Organic revenues in 2024 (excluding the inorganic contribution of acquisitions and the effect of the exchange rate) rose by 10%, with ATM increasing by 23%, Defence by 23% and Minsait by 6%. In the last three months of the year, organic revenues increased by 7% (Defence and ATM by 22% respectively and Minsait by 7%, with Mobility falling by 28%).

Revenues by geographical areas also underwent double-digit growth in Europe (up 18%, with this region accounting for 20% of total sales), Spain (up 16%, accounting for 51% of total sales) and the Americas (up 5%, 20% of sales), while revenues declined in AMEA (down 6%, accounting for 9% of sales).

Ordinary revenues rose by 12% in 2024 and 9% in the fourth quarter.

Other Revenues stood at €104 M in 2024 compared to €74 M in 2023, mainly due to the higher level of subsidies and work on fixed assets.

Further increase in the backlog

The backlog totaled €7.245 billion in 2024, up 7% in comparison with 2023, driven by Minsait and ATM. The ratio between the backlog and sales in the last twelve months stood at 1.50x, set against the figure of 1.56x in the same period of the previous year.

The net order intake in 2024 increased by 17%, with a sharp rise in all of the divisions and strong growth in ATM, mainly due to the contracts in Canada and Colombia, and Defence, owing to the radar contracts in Poland and Vietnam. The book-to-bill ratio with respect to sales stood at 1.11x vs. 1.06x in 2023.

Other important figures

The EBITDA margin stood at 11.3% in 2024 set against 10.3% in 2023, a 22% increase in absolute terms. This rise can be mainly put down to the greater growth in revenues recorded in the divisions with the greatest operating profitability (Defence and ATM), as well as the improved returns of Mobility and Minsait. It can also be put down to the operating efficiencies achieved in all of the divisions. In the fourth quarter of the year, the EBITDA margin rose to 12.2% vs. 10.6% in the same period of the previous year, increasing by 24% in absolute terms.

The operating margin stood at 10.6% in 2024 compared to 9.3% in 2023, with a 27% rise in absolute terms. Other operating income and expenses (the difference between the Operating Margin and the EBIT) in 2024 amounted to -€74 M vs. -€56 M in 2023, with the following breakdown: -€45 M workforce restructuring costs vs. -€26 M, the impact of the PPA (Purchase Price Allocation) on the amortization of intangibles totaling -€16 M vs. -€14 M, and the provision for stock-based compensation of the medium-term incentive amounting to -€12 M vs. -€15 M. In the fourth quarter of 2024, the operating margin reached 12.4% vs. 10.1% in the same months of 2023, while other operating income and expenses stood at -€31 M vs. -€15 M in the fourth quarter of 2023.

The EBIT margin stood at 9.0% in 2024 compared to 8.0% in 2023, an increase of 26% in absolute terms. In the fourth quarter of the year, the margin rose to 10.2% from 9.0%, rising by 24% in absolute terms.

The Net Profit amounted to €278 M in 2024 compared to €206 M in 2023, an increase of 35%. The net profit grew by 56% in the quarter alone.

In 2024, the Free Cash Flow stood at €328 M vs. €312 M in 2023, due to the greater profitability of operations and despite the higher Capex. The FCF in the last quarter stood at €234 M vs. €195 M in the fourth quarter of 2023.

With respect to the Net Debt, the group ended December 2024 with a positive Net Cash position amounting to €86 M, compared to the -€107 M net debt in December 2023. The Net Debt/LTM EBITDA ratio (excluding the IFRS 16 impact) stood at -0.2x in December 2024, compared to 0.3x in December 2023.

Goals for 2025*

• Revenues in local currency: greater than €5.2 billion

• Reported EBIT: greater than €490 M.

• Reported Free Cash Flow: greater than €300 M.

*Does not include the acquisitions of TESS Defence and Hispasat

Other events during the quarter

The leading events in the fourth quarter included:

• On October 9, Indra Group announced the acquisition of 100% of MQA, a benchmark company in SAP business management solutions in Colombia and Central America, with a large backlog of top-tier customers with a high degree of maturity. With this purchase, Minsait will strive to enhance its range of digital products and international business.

• On October 29, within the framework of the implementation of the Leading the Future Strategic Plan, Indra Group reached an agreement with the remaining shareholders of TESS DEFENCE, S.A. (“TESS”), a Spanish company specializing in the design and production of state-of-the-art military ground vehicles, with a view to increasing its stake in TESS from the current figure of 24.67% to 51.01%, for the amount of €106.7 million, with the remaining share capital distributed as follows: Santa Bárbara Sistemas, S.A.: 16.33%; Escribano Mechanical & Engineering, S.L.: 16.33%, and SAPA Operaciones, S.L.: 16.33%.

• On November 4, Indra Group’s Board of Directors approved the purchase of 100% of the share capital of “Micro Nav”, the leading air traffic and air defence simulator company, and “Global ATS”, the air traffic control training services firm, a prominent player in the market in the United Kingdom. With this operation, Indra will position itself with a view to meeting the growing demand for these kinds of simulation and air traffic control training solutions and services among its customers, not only strengthening its position in the United Kingdom, but also in the Middle East and Asia-Pacific.

• On December 18, Indra and EDGE Group entered into a joint venture known as PULSE to design and manufacture radars in Abu Dhabi. The agreement is aligned with the Leading the Future Strategic Plan and EDGE’s ambition to expand sovereign capabilities by driving innovation and high-tech production in the United Arab Emirates.

The following events subsequent to the end of the quarter should also be mentioned:

• On January 31, Indra entered into an agreement with Redeia Corporación, S.A. (“Redeia”) to acquire 89.68% of the share capital of Hispasat, S.A. (“Hispasat”), a satellite service operator and provider, for the amount of €725,000,000, for which purpose Indra secured financing for a total of €700,000,000, with the remaining amount expected to be covered with a charge to existing cash.

• On February 26, Indra Group’s Board of Directors agreed to propose, at the next General Shareholders’ Meeting, the distribution of a cash dividend totaling €0.25 gross per share, to be charged against the profits for 2024 and paid on July 10, 2025.

Main figures

Acquisitions provided a total of €182 M in sales in 2024 vs. €44 M in 2023. The acquisitions of NAE, Deuser, ICASYS, Tramasierra, Totalnet, Pecunpay and MQA contributed inorganically to Minsait, while the Selex Air Traffic business in the US and Park Air did so to ATM. GTA (after the increase in its stake from 35% to 100%), Deimos and CLUE contributed to Defence. These acquisitions contributed €73 M vs. €30 M in the fourth quarter.

Revenues by divisions and geographical areas