- Net profit advances 7%

- Revenue up 2%, with 7% growth in the international market

- Order intake improves 6%, up 11% in the international market

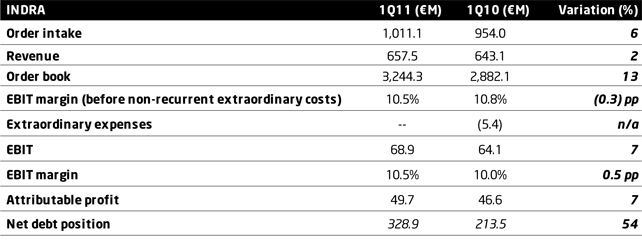

Indra performed well during the first quarter of 2011 despite the challenging domestic market, closing the period with net profit of €50m, 7% higher year-on-year.

Revenue rose 2% year-on-year overall to €657m. The international market was strong with revenue increasing 7%, representing 41% of the total. The highest increase came from Latin America where revenue advanced 30% year-on-year, followed by Asia Pacific. These strong figures helped offset the 1% decline in the domestic market. This figure was in line with expectations given the budgetary restraints of institutional clients which was offset by higher activity from corporate clients.

Indra’s order intake totalled €1,011m, a 6% increase on the same period last year. The international market continues to enjoy double digit growth (11%) and the domestic market is also strong, up 4%. The Services segment reported 27% growth in order intake while the Solutions business saw a drop of 9%, although this is expected to improve as the year progresses. The book-to-bill ratio at 31 March was 1.54x, a slight improvement on the same period last year.

The order backlog jumped 13% to €3,244m, equivalent to 1.26x revenue for the last twelve months.

The EBIT margin for the quarter was 10.5%, 0.5 percentage points wider than the same period last year.

2011 guidance

Indra reiterates the 2011 guidance it announced in January on the back of the company’s strong performance during the first quarter and the outlook for the rest of the year. Revenue coverage stands at 80%, in line with last year’s figure for the same period. Our guidance is:

- Revenue growth of more than 2%, with significantly higher growth in the international markets, offset by a slightly negative performance by the Spanish market.

- Order intake slightly ahead of last year’s and significantly higher than revenue, further bolstering the order backlog.

- An EBIT margin of at least 10.5%, with no actions entailing additional extraordinary expenses expected in 2011.

Proposed dividend

The Board of Directors has resolved to propose to company shareholders at the next General Shareholders’ Meeting to be held on 21 June the distribution of an ordinary dividend of €0.68 per share against 2010 results, 3% higher than the dividend paid against 2009 results. This represents a pay-out level of 59%.

KEY FIGURES

The following table lists the key figures for the period: